Here is how it works:

1. You have a $1M house today

2. Apply for $350,000 garden suite financing/refinancing

3. Receive financing for up to 90% of the value of the entire property, including the “new value” of the garden suite:

- $1.35M x 90% = $1.215M total can be financed in the new or adjusted insured mortgage

4. Build the garden suite with $350,000 in funds from the new insured financing

In the scenario above, as long as you have at least $135,000 equity in the existing house, you can finance/refinance and build the garden suite with zero cash outlay.

The new financing/refinancing can be ammortized over 30 years to decrease the monthly payments.

.

.

.

Freeland announces new actions to encourage building of secondary suites, more homes

The first action is changes to how lenders and insurance companies can offer mortgage refinancing for homeowners looking to convert an unused basement or garage into a rental suite.

Homeowners can now refinance their current mortgage and construct a secondary suite, with borrowers able to access up to 90 per cent of the home’s value, including the value of the extra suite. The borrower will be able to amortize the refinanced mortgage over a period of 30 years.

The federal government also said it is increasing the mortgage insurance home price limit to $2 million for those refinancing to build a secondary suite, saying this will ensure homeowners can access their refinancing in all housing markets across Canada.

.

.

.

Feds launch mortgage refinancing program to boost secondary suites and ease housing crunch

.

.

.

Government press release:

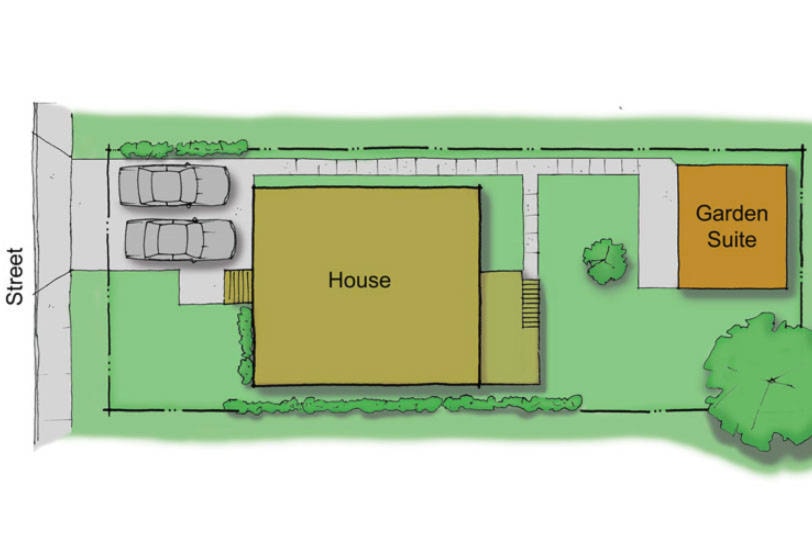

Many homeowners have extra space they may want to convert into rental suites, such as an unused basement, or a garage that could be converted into a laneway home. Historically, the cost of renovating, combined with municipal red tape, has made this both difficult and expensive.

Recent municipal zoning reforms in Canada’s major cities, made possible through Housing Accelerator Fund agreements, are creating new opportunities for homeowners to add additional suites and increase density. New rental suites would provide more homes for Canadians and could provide an important source of income for seniors continuing to age at home.

In Budget 2024, the federal government announced its intention to make targeted changes to mortgage insurance rules to encourage densification and enable homeowners to add more units to their homes.

Today, the government is releasing details for lenders and insurers to offer this new insured mortgage refinancing product, effective January 15, 2025.